It is comparing the return of an asset with the net earnings of the total assets. It helps to provide a relative amount of the company’s efficiency in helping support to build a profit. And also apply a key as a tool for detecting management performance. The statement return on the asset can use as a result of the efficiency of real property that operates within a company. Since each of the businesses may need hardly Return On Assets Formula? To sell so that it may provide goods and services to the potential client. But the property base of a company could vary to point between companies. For example, if the return on asset of related asset production and the facility cannot be comparable to the asset-light advising business’s return.

Return on asset is kind of a profitability ratio. It provides how much profit a company can get from its support. Return on investment generally says how hard a company and its management are creating money from the money source or its property on its balance sheet. ROA basically shows as a percentage. The higher the number that means that the more efficient the management of the company is. For the efficiency of the company, it is necessary to manage the balance sheet for making profits.

Table of Contents

Calculate the return on assets

The average amount of property is used to calculate the return on an asset. A company’s assets can change from time to time. In case of buying or sell the car, land sell, inventory management, seasonal sales management. The conclusion calculates the average total asset in time—some questions like how a company can be more right to gain an entire purchase for one period. If we see the complete support of any company, we can easily find the company’s total asset.

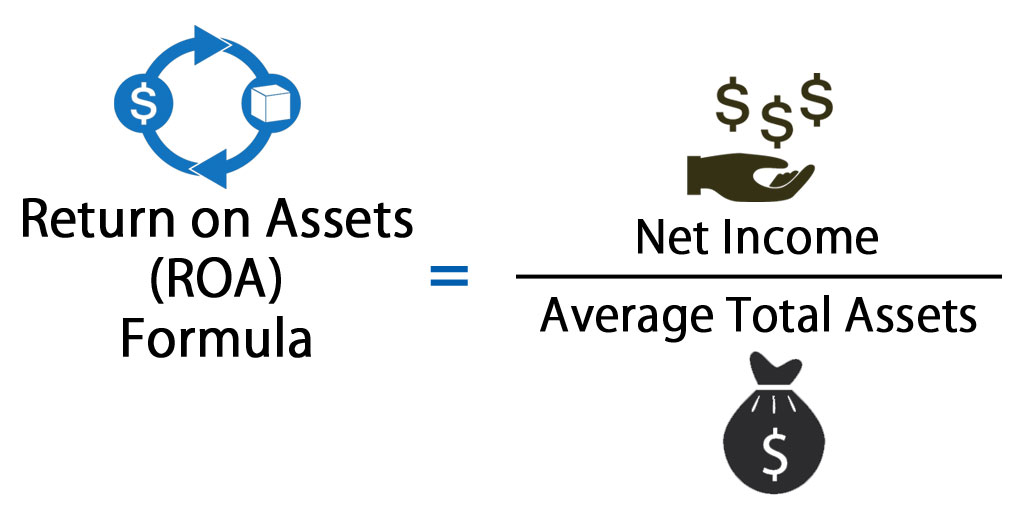

The formula of ROA is

ROA=Net income / Average total asset

The net income in Return On Assets Formula

Net income is basically found at the bottom of the company’s income statement. It uses a number creator. Net income means what amount of total revenue remains after calculating all the expenses. Expenses like production, operation, overhead, administration, debt service, debt, tax, deprecation.

There are some one-time category expenses critical events such as a high purchase.

Net profit also counts for extra income that is not directly related to their primary operations—for example, one-time payments for the sale of the assets.

What investors’ things on return on assets formula

By counting the return on asset of a company can help compare with the company’s profit with extra quarters and years. It also helps to compare with similar other companies as well. So it is important to compare companies of equal size in the industry.

Examples like banks that intend to have a high number of the asset’s total volume on the balance sheet in loans, investment, and cash. A big bank can manage over easily with 2$ trillion. The support while putting up the net income is similar to the other industries. Nut the bank’s net profit can be the same as the unrelated companies. The bank might have a high quality of assets. In that case bank’s return on investment will be lower. The big number of help also can be divide into net income. It happens to create a lower return on support for the bank.

Same to auto manufacturing requires the same facility and special machinery. Critical software that sells downloaded software online can generate the same net profit. But it can be a high return on the asset because of its heavy return complements. When using the metric to match the business’s output, it is important to consider what type of function is making to the company. It is easier just to compare the result.

The necessity of return of an asset

Return on asset lets the investor think how much after expense profit is. It also helps to consider how the company generates each dollar of investment. Return on asset Counts Company’s relation in case of earning. How many assets are used in an effective way that also can found in ROA? The size is the sign of management with how much support has been using. The profitability graph has been designing to

give an idea to the investors how a shareholder can generate revenue.

High return on asset means better for the company. Low ROA is not good for the company. So the company should be more careful about using ROA. But one thing to remember that ROA cannot help to compare industry. Sometimes it does not also help compare companies in the same industry—the reason behind this is that not all companies or businesses identically utilize their assets.

ROA and ROOA are totally different tools in case of effective comparison. It should be in the same structure or have similarities between the companies. Through the business performance over time and based on assets, it changes significantly. So the ratio should be check from time to time.

Limits

When using the return on assets, some things should be known.

- Time covered: some business is seasonal, so the profits can vary by month. To neglect the issue, the company should run the calculation yearly basis.

- Asset maintaining: all the assets that show in the balance sheet in a single time. The total investment on that point can be change depend on uses. It because of the disposal of an asset. Suppose you need to change the average assets based on multiple months of the balance sheet.

- The fact of debt: it is a part of the financial structure. So the entity should be the same in the name of debt. For the return of a negative asset, interest should be subtracted from the net profit.